As an employee, you may not always know whether you’re classified as an employee or an independent contractor – especially under Employment Law in California. However, the distinction is important because it determines your rights and protections under the law. In California, worker classification is determined by a set of criteria that takes into account factors such as control, the nature of the work, and whether the worker is engaged in an independently established trade or business. However, many employers misclassify their workers as independent contractors, denying them the benefits and protections that come with employee status. In this blog post, we’ll explore state law on worker classification, recent misclassification cases in California, and the implications of these cases for workers and employers.

California Law on Worker Classification: What is the ABC Test?

Worker classification is a complex legal issue that has been the subject of much debate and litigation. In California, worker classification is governed by a set of criteria established by the California Supreme Court in the Dynamex decision. Under the Dynamex decision, a worker is presumed to be an employee unless the employer can establish that the worker meets all three prongs of the ABC test.

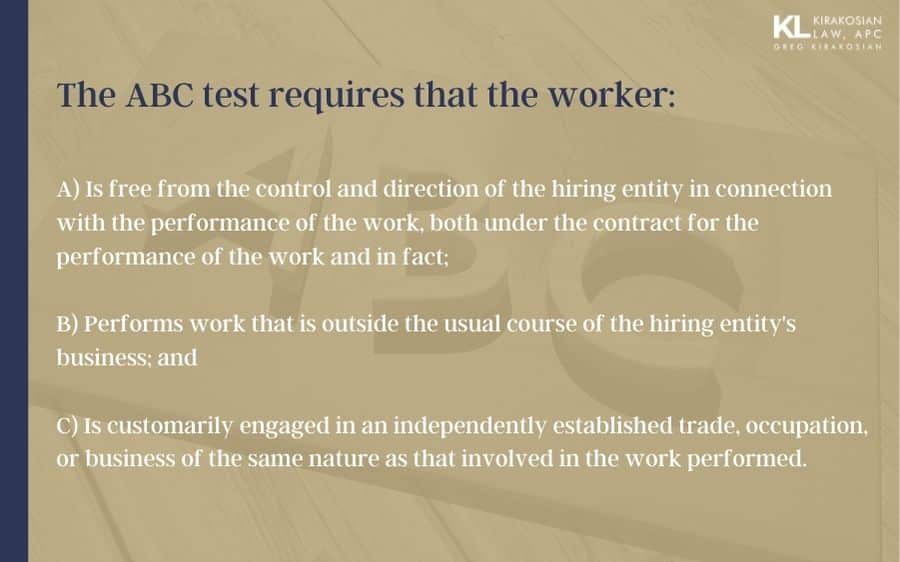

The ABC test requires that the worker:

- A) Is free from the control and direction of the hiring entity in connection with the performance of the work, both under the contract for the performance of the work and in fact;

- B) Performs work that is outside the usual course of the hiring entity’s business; and

- C) Is customarily engaged in an independently established trade, occupation, or business of the same nature as that involved in the work performed.

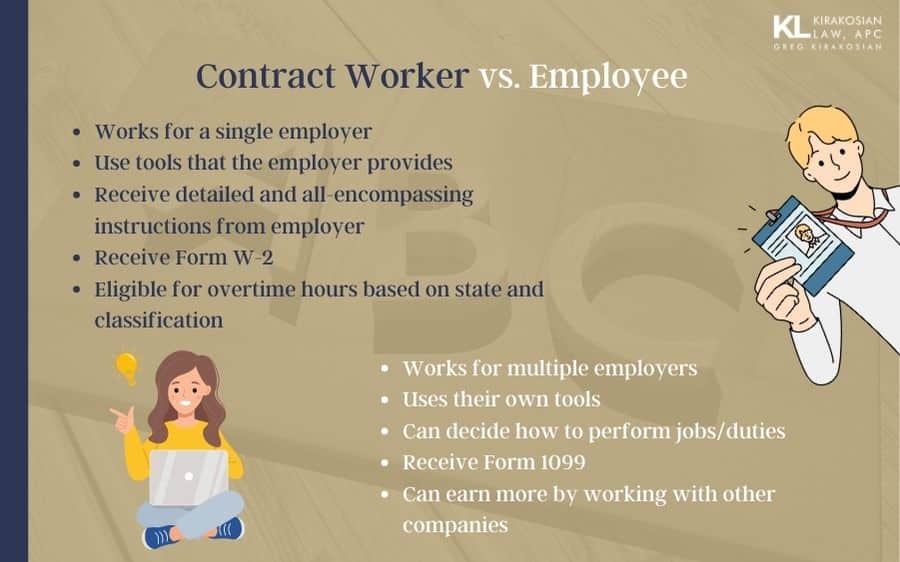

These criteria are used to determine whether a worker is an employee or an independent contractor. For example, if a worker is performing work that is essential to the employer’s business and is subject to the employer’s control and direction, they are likely to be classified as an employee. On the other hand, if a worker is providing a service that is ancillary to the employer’s business and is able to set their own hours and work independently, they may be classified as an independent contractor.

It’s important to note that the criteria for worker classification are not always clear-cut, and there is often room for interpretation. That’s why it’s important to consult with an experienced employment lawyer if you’re unsure about your classification.

Misclassification Cases in California

Misclassification is a widespread problem in California, with many employers misclassifying their workers as independent contractors to avoid paying employment taxes, workers’ compensation, and other benefits. Recent misclassification cases in California have involved companies like Uber, Lyft, and DoorDash, all of which have faced legal challenges over their worker classification practices.

In 2018, the California Supreme Court issued its landmark Dynamex decision, which made it much harder for employers to classify their workers as independent contractors. The decision established the ABC test as the standard for worker classification in California and made it more difficult for employers to classify their workers as independent contractors.

The impact of the Dynamex decision was felt throughout California, and many companies that had been classifying their workers as independent contractors were forced to reclassify them as employees. This led to a flurry of lawsuits and legal challenges, with workers seeking back wages, benefits, and other compensation for the time they had been misclassified.

One of the most high-profile misclassification cases in California was the Uber settlement. In 2020, Uber agreed to pay $640 million to settle a lawsuit brought by its drivers, who claimed that they had been misclassified as independent contractors. The settlement was a major victory for workers’ rights advocates, and it sent a strong message to employers that misclassification will not be tolerated.

Implications of Misclassification Cases in California

Misclassification has far-reaching implications for both workers and employers. It is important to note that employers who misclassify employees as independent contractors not only violate labor laws but also miss out on certain benefits that come with proper classification. For example, employers who misclassify employees as independent contractors do not have to provide benefits such as minimum wage, overtime pay, and workers’ compensation. This leaves employees vulnerable to financial insecurity and health risks, among other issues.

In addition to the financial and legal implications of employee misclassification, there are also social implications. Employees who are misclassified often have limited access to career advancement opportunities, job security, and benefits that are afforded to properly classified employees. This can lead to a two-tiered workforce where some employees have access to better pay and benefits, while others are left behind.

California law provides several tests for determining whether a worker is an employee or an independent contractor. One of the most commonly used tests is the “ABC test,” which was codified by the California Supreme Court in the 2018 Dynamex Operations West, Inc. v. Superior Court decision we mentioned earlier. Under the ABC test, an individual is presumed to be an employee unless the employer can prove that they are not. See Image.

The ABC test has made it more difficult for employers to classify workers as independent contractors in California. In fact, in April 2019, a federal judge ruled that the ABC test should be used to determine employee classification for cases under the Fair Labor Standards Act. This ruling is a significant victory for workers and employee rights advocates.

In Summary, Employment Law is Both Tricky and Straightforward

Despite the legal protections in place, employee misclassification remains a pervasive issue in California. For example, in 2019, the California Labor Commissioner’s Office ordered a trucking company to pay over $1 million in back wages and penalties for misclassifying truck drivers as independent contractors. The drivers were owed unpaid wages, overtime, meal and rest break premiums, and other benefits that they were denied as a result of the misclassification.

It is crucial for employees to understand their rights and for employers to understand their obligations when it comes to proper employee classification. If you believe that you have been misclassified as an independent contractor or if you are an employer who needs guidance on proper classification, it is recommended to seek the advice of an experienced employment law attorney.

In conclusion, employee misclassification is a serious issue that affects both workers and employers. The legal and financial consequences of misclassification can be significant, and the social implications can be far-reaching. California law provides protections for employees, but it is up to employers to comply with these laws and properly classify their workers. If you are an employee who believes they have been misclassified or an employer who needs guidance on proper classification, don’t hesitate to contact a qualified employment law attorney to help you navigate these complex issues.